In my stock valuation model, published August 25, 2008, I walked through my methodology for valuing the stock market, which is based on trend earnings. At the time I thought if you wanted to achieve an 8% long term return, which is what you reasonably can expect, you would need an S&P 500 valuation of 779. Unfortunately, the numbers have gotten a lot worse since then, as trend earnings have come way down due to the unprecedented swings in real earnings over the past 3 years and expected over the next two.

2008 trend earnings have fallen from $58.65 to $50.37 and the trend growth rate has fallen from 1.74% to 1.24% per annum. The drop makes sense because, as it turns out, 2005-2007 earnings turned out to be a sham, riding on artificially inflated bank and oil company earnings. Diminished future growth expectations make sense too, as it is fair to say that the world is going to be less corporate-friendly for at least the next several years and slower workforce growth should drag down GDP growth.

Assuming a long term inflation rate of 2% and a 50% normalized payout on trend earnings, today's S&P 500 level of 798 yields a long-term expected return of 6.5%.

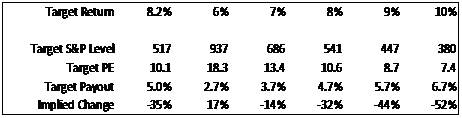

Below are desired S&P 500 values at various return targets (I use 8.2% as the equilibrium target):

I maintain my position that the market only gets interesting at S&P levels below 600, and that seeing a value below 500 would be entirely plausible. Nominal stock market returns were exaggerated in the second half of the twentieth century due to high levels of inflation, which add to corporate earnings. I believe the pendulum will swing to lower inflation in the first several decades of the twenty-first century, which will increase the relative appeal of bonds at the expense of equities. A shift to bonds would also make sense for the aging populations of the developed countries as they rapidly near retirement.

The table below compares stock returns to other market yields (represented by the yields of various Vanguard fixed income mutual funds), and to what I consider equilibrium market yields:

The non-treasury fixed income market continues to offer decent values. The Vanguard Ginnie Mae fund is also appealing, as it is yielding 4.2% with the same credit risk as treasuries. (GNMAs have less price appreciation potential due to mortgage refinancing risk). If you don't have the stomach for high yield, muni bonds and high grade corporates offer pretty good risk-adjusted returns relative to equities.