Some big announcements have been made since my last (fairly pessimistic) GDP update.

-

The Fed plans to pump $2TN into the economy. On April 18 the Fed announced a plan to pump up to $2 trillion into the economy by buying long term treasuries, asset backed securities, mortgage backed securities and agency securities. Interestingly, this amount corresponds to the capital shortfall I discussed in my essay on bank capital shortfalls.

-

Isn't this massively inflationary? Not necessarily. The low treasury yields (high prices), stable gold prices and relatively strong dollar imply a shortage of risk-free money and securities relative to demand. The other component of the money supply, financial system leverage to support risk capital is trying to shrink, while the demands on risk capital (supply of securities) remain high. By increasing the supply of risk-free money to reduce the demand for risk-based money, the Fed is moving toward creating more of an equilibrium in the capital markets. If you see gold rocket well north of $1,000 and the dollar break through the bottom of its long term trading range, then the inflation alarm bells can be rung.

- Does this solve the financial problem? No. But it should cushion the deterioration in the financial markets. The Fed is providing loans, not increasing the equity capital of the banks.

- What about Treasury's plan to buy toxic assets? I thought the best take on this was by the WSJ's Simon Nixon. Basically, there is a good chance the program won't work, because the banks' view and the private sector's view of the value of the "toxic" assets will diverge too much. Nevertheless, this will give the Fed ammunition to go to Congress for the proper amount of capital to inject into the big banks and to crush the remaining equity at places like Citigroup. If the program does work, on the other hand, we are a long way toward properly capitalizing the banks. In other words, we are moving in the right direction.

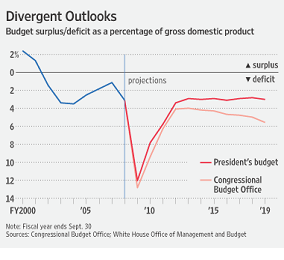

- Who is more fiscally reckless, Obama or Bush? Many Obama supporters consistently lambasted Bush for his deficits, even though he too inherited a major crisis in the combination of the telecom/dot-com meltdown and 9-11. In both the Obama administration's and the CBO's projections, there is not a single year that Obama will produce a fiscal deficit (relative to GDP) significantly smaller than George Bush's worst deficit. I am shocked! shocked! that both parties are hypocrites when it comes to fiscal responsibility.

- Hopefully, in the end the TARP won't really count as part of the deficit, because the funds were used to buy assets that will eventually provide a positive return to the government (here's to hoping). Sadly, the near term deficits may be necessary to allow the private sector to deleverage.

- Will this "triple-barreled shotgun" of money revive the economy? Probably. I assume the "second derivative" of economic decline bottomed in the Q4 2008 and Q1 2009, and that growth may turn positive toward the end of the year. I am hearing anecdotal evidence of increases in car loan and mortgage applications. Housing inventories may have started to decline (at lower prices), meaning that as a percent of GDP, housing investment may have bottomed. (I do expect house prices to continue to decline, however, as the market starts clearing.) Inventories may be bottoming out now and be due for some restocking. That said, consumer spending will continue to be weak as savings rises and the job market lags the economy (as always), business investment will likely be very weak in the next couple of quarters and commercial real estate investment still has a long way to fall. The only sustainable way out of this hole is for the US to borrow demand from abroad via trade surpluses. Until that happens, we are still surfing from bubble to bubble.

I share your degree of “shock” at each party’s hypocrisy. With all the hearings pertaining to AIG bonuses (.001% of our problems) and other matters, Congress has gotten more airtime than Dora The Explorer. Unfortunately Dora seems more thoughtful.

I hope the PPIP, or PPIF’s, plan cleans up the bank balance sheet and reprices risk into the proper hands. However, I am afraid there are signficant disentives and however publicly we have considered problems with RMBS, as today’s WSJ discusses (and detailed in a report from Deutsche Bank last week if you wish), CMBS may be even uglier. 30-60-90 Day delinquencies are comparitively low at 1.8% (9.55% national RMBS) but loss severity may be quite a bit higher. And the problems continue through other bank asset classes.

Like our President, and candidate McCain before him, I have confidence in our economy and society. But our “recovery” will be anemic. Thanks for taking the time to air it out. Inflation – a perennial topic we have discussed – is an entirely different matter.

LikeLike